VAT Voluntary Disclosure

A voluntary disclosure is a form provided by Federal Tax Authority (FTA) to allow businesses and taxpayers to notify FTA about the errors/mistakes and omission/changes in a Tax return or Tax Refund. A VAT Voluntary disclosure form 211 in UAE helps a taxable person to make correction in the errors they have committed while submitting a VAT Return or applying for the VAT Refund. It gives a choice to the taxable person or business to voluntarily disclose the mistakes they have done in the previous VAT Return or VAT Refund.

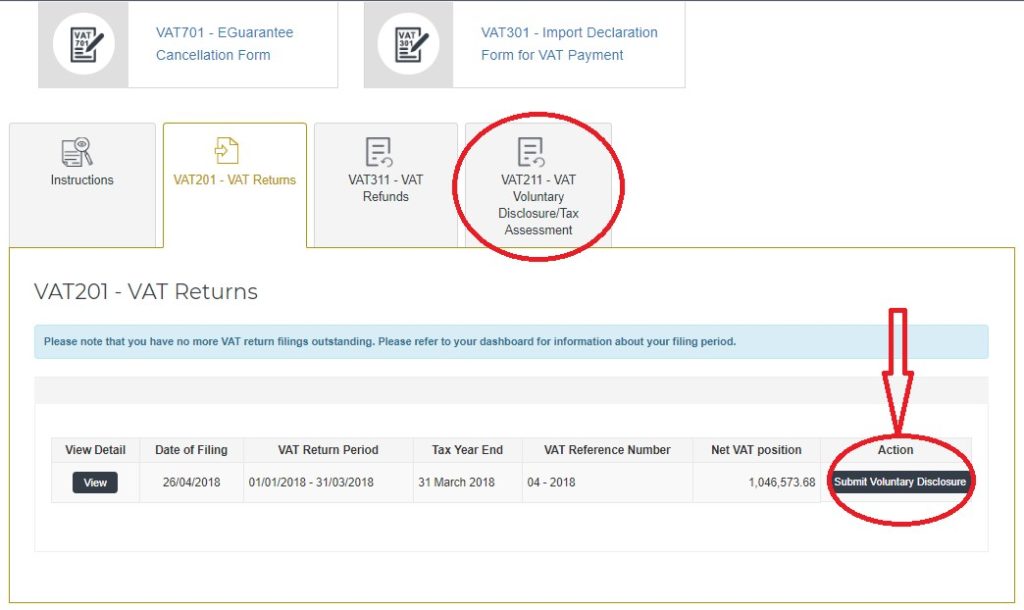

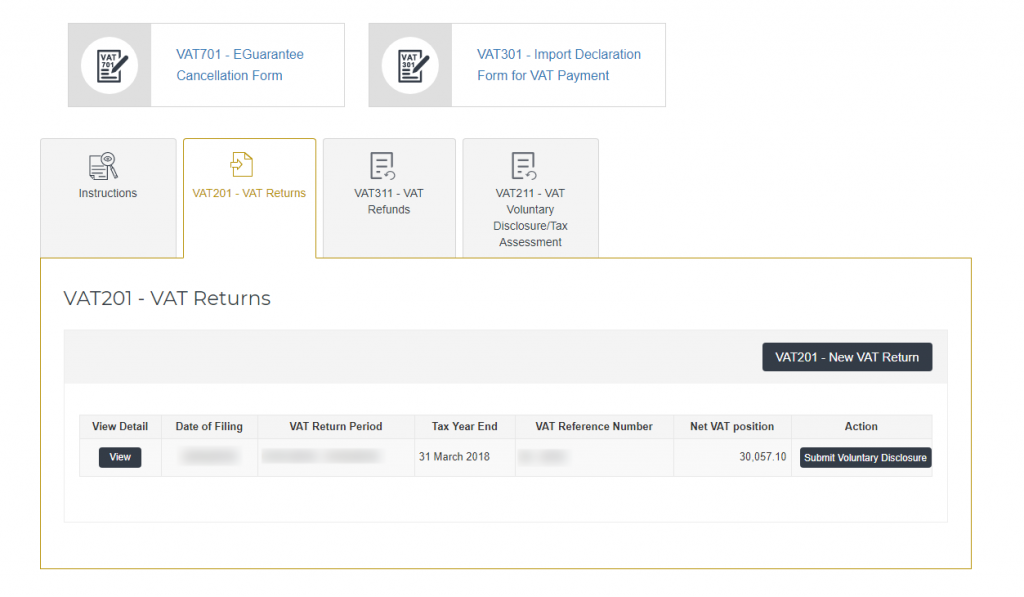

VAT Voluntary Disclosure Form 211

If a taxable person makes an error or omission or a wrong treatment of tax by which the output tax payable or input tax recoverable is more than AED 10,000/- for a particular period then, he must use the VAT Voluntary Disclosure form 211 to inform the authority. There are different situations when you must submit a VAT voluntary disclosure to the FTA, such as:

- If you know that the tax return submitted by you to the FTA is incorrect which resulted in a calculation of the Payable Tax according to the Tax Law being less than it should have been, you must submit a VAT Voluntary Disclosure to correct such error.

- If you know that the tax return submitted by you to the FTA is incorrect which resulted in a calculation of the Payable Tax according to the Tax Law being more than it should have been, you must submit a VAT Voluntary Disclosure to correct such error.

- If you know that the tax refund submitted by you to the FTA is incorrect which resulted in a calculation of the Payable Tax according to the Tax Law being less than it should have been, you must submit a VAT Voluntary Disclosure to correct such error.

- If you know that the tax refund submitted by you to the FTA is incorrect which resulted in a calculation of the Payable Tax according to the Tax Law being more than it should have been, you must submit a VAT Voluntary Disclosure to correct such error.

When a taxable person or business should not submit a voluntary disclosure form to FTA?

Taxable person or businesses are not required to submit a Voluntary Disclosure for the underpaid tax if the amount of the Payable Tax is not more than AED 10,000 as long as the person is able to correct the error in the Tax Return for the tax period in which the error has been discovered

Time Limit for submitting a VAT Voluntary Disclosure

VAT Voluntary disclosure form – 211 must be submitted to the Federal Tax Authority (FTA) within 20 business days from the date when the taxable person became aware of the error.

SAB is an approved tax agents by the Federal Tax Authority (FTA), Contact us now for the assistance in the submission of VAT Voluntary disclosure.

SAB is one of the approved Tax Agents by FTA and will assist you by providing VAT Deregistration services in UAE. SAB will help your business to grow by avoiding any fines and penalties through providing the following services:

- VAT Accounting

- VAT Return Filing

- VAT Services

- VAT Consultancy

- VAT Training

- Tax Agent Services

- Tax Audit Services